The Home Success MCC, or Mortgage Credit Certificate, down payment assistance program is a federal income tax credit program. the Home Success MCC allows homeowners to take a federal income credit of 25% of the annual interest paid, up to $2000 per year. Given that this is a tax credit, it’s a bit different than the previously outlined DPA programs: Home in Five, Home Plus, Arizona HFA Preferred, the Pima Tucson Homebuyer’s Solution, the City of Phoenix Open Doors, the American Dream DPI, and the Chenoa Fund.

A couple of added perks of the Home Success MCC is that owners are allowed to take a tax credit for every year they have a mortgage while living in their home, even if the original loan is refinanced. This program works with FHA, VA, USDA-RD or conventional loans, such as Fannie Mae or Freddie Mac. Furthermore, recipients may be able to use both the Home Success MCC and the Home in Five programs together!

Program Details and Application Process

The Home Success MCC applies to owners within the city of Phoenix. To see if your home falls into that boundary, go to the Phoenix Map Services and type in your address. The next step is to find a lender enrolled in the Home Success program to pre-qualify for financing and an MCC. An escrow must be opened before applying for an MCC, so be sure to find a property, finalize, and sign a purchase contract. Sign both the MCC application prepared by your lender as well as the closing affidavit with the aforementioned loan and closing documents at the close of escrow. Home Success MCC documents will come by mail 60 to 90 days after the escrow closes.

Something to keep in mind is the possibility of a recapture tax. If you sell your home within nine years, you may have to pay a recapture tax, though there are several conditions that would provide exemptions from this. It’s recommended you consult both a qualified lender as well as a tax professional for more information.

Homebuyer Eligibility

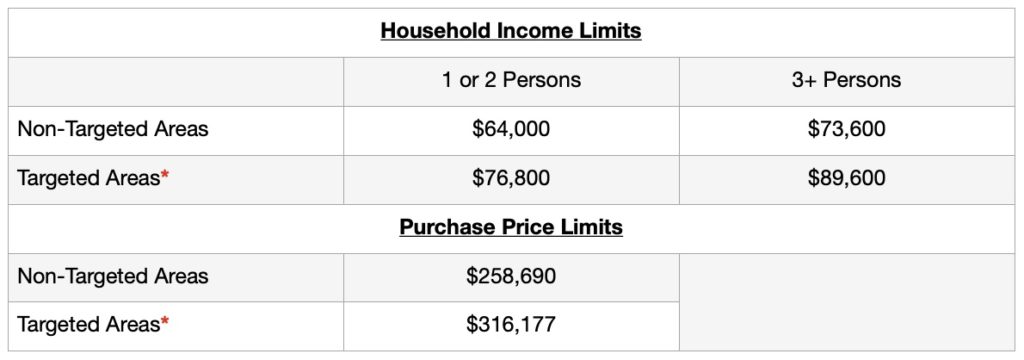

The Home Success MCC does have some income limit requirements, which can vary based on if your property falls inside or outside of Targeted Census Tracts.* See the table below for the income and purchase price limits.

This program is for first-time homebuyers only, meaning that you have not owned a home within the last three years (36 months). Additionally, you must occupy the single-family detached home, condominium, townhouse, or duplex purchased within 60 days of closing. Applying through a participating lender may include fees (less than 0.6% of the purchase price).

Standard requirements with relevance include a minimum FICO score of 640, a home inspection, and completing a homebuyer education course. Prospective buyers can find a list of HUD-approved Housing Counseling agencies providing the course locally through hud.gov.

To learn more about the Home Success MCC down payment assistance program, contact your local licensed loan officer and determine if this federal tax credit is something you’re eligible for.

*Certain census tracts receive additional incentives. Applicants who purchase homes in these areas do not have to be first-time homebuyers and the income and purchase price limits are higher. Check the Census Tract Map to see if your new home is in a designated area. Any 2014 qualified census tracts are eligible for additional incentives (pink and green sections)! Speak with your lender or realtor for additional details.