Phoenix, Arizona tops the housing market negatively impacted by investors in April 2021 by removing over 400 units. Nationwide during the same month, the number of units removed from the market was higher than contributed, with investor purchases allotting for over 5.5% of all home sales.

The conventional thinking is that the average buyer is competing with investors, but a recent report from Realtor.com disputes this claim. Realtor.com found that investors are actually heightening the inventory shortage in 31 of the top 50 United States markets. Conversely, in the 19 other major markets, they’re actually contributing to the inventory of homes for sale.

Realtor.com found their data by examining U.S. deed records between January 2000 and April of 2021 to calculate the investor sales versus purchases in the aforementioned 50 major U.S. markets. Their criteria is such that investors are selling more homes than they’re buying. And areas where investors are removing homes from the market are areas where investors are buying more homes than they’re selling, which includes Phoenix.

“Today’s buyers are facing a tough market and data shows they aren’t just competing with each other. With deep pockets and more flexibility, investors can be daunting competition for the typical homebuyer. Right now, data shows investors are buying more homes than they are selling, and while they get a lot of attention in today’s market, it’s worth remembering that they can also contribute to inventory levels,” said Realtor.com Chief Economist Danielle Hale. “Whether a market is appealing to investors depends on a variety of factors, including how local home prices compare to rents. When home prices are rising and rents are more stagnant, investors are more likely to sell off properties and contribute inventory. On the other hand, the higher rents are compared to home prices the more attractive the market is to investors looking to buy homes and convert them into rental properties.”

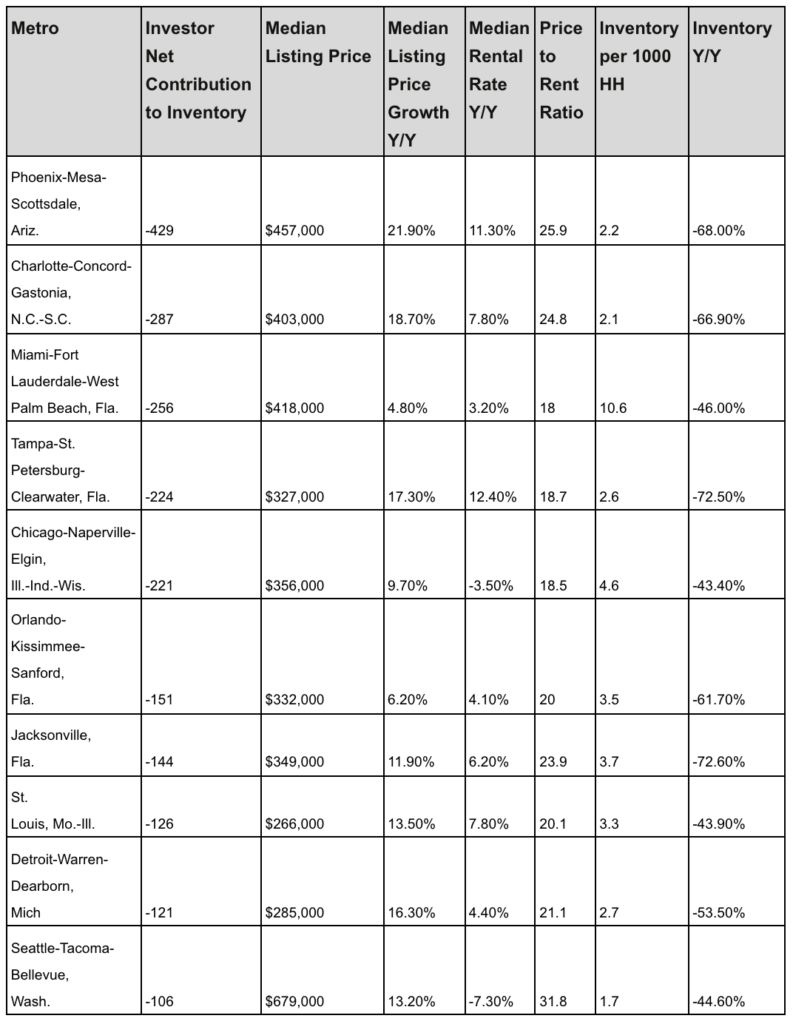

Top 10 Markets by Net Negative Contributions to Inventory

How do these major markets measure up? Here’s a brief breakdown of the top five. These metropolitan areas are smaller and less densely populated and with more homes listed vis-a-vis all households, and feature lower prices relative to higher rental price than the markets where investors assisted buying homes.

- Phoenix, AZ: -429 homes

- Charlotte, NC: -287 homes

- Miami, FL: -256 homes

- Tampa, FL: -224 homes

- Chicago, IL: -221 homes

A more detailed chart can be found below further explaining how Phoenix tops this impacted market:

Sure, the average home price is more affordable in these areas, but rental prices grew at a faster rate of over 4.5% year-over-year than the 0.1% of the markets with higher investor sales in April 2021.

Overall, when lined up with the national inventory decline of 53% in April, the top 10 markets with investors contributing to the market saw a smaller drop of only 44%, though some saw even larger inventory gaps as compared to the previous year.

Lexie Hale of Realtor.com added, “High home prices, slower rent growth, and uncertainty over the future of work in these markets are likely causing investors to reevaluate their property portfolios in these areas. And with homes still selling quickly, even in these metros, an investor deciding to sell can look forward to being able to reposition their dollars elsewhere in a very short period of time.”